Plenty :: PLY Tokenomics

November 22, 2022This article contains information about the distribution, migration, and emissions of the new Plenty protocol PLY token.

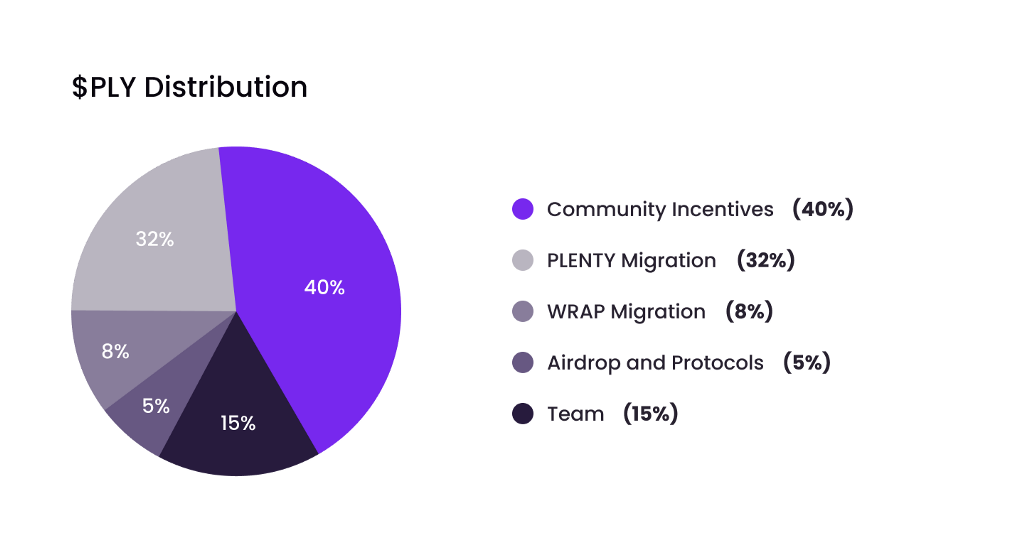

Distribution

The total supply of PLY is capped at 1 billion tokens. The distribution is as follows:

40% (400 million PLY) — Existing PLENTY and WRAP holders through migration.40% (400 million PLY) — Community incentives emitted through gauges.15% (150 million PLY) — Reserved for the current and future members of Plenty’s core team.5% (50 million PLY) — Reserved for airdrops, marketing and, partnerships with existing Tezos protocols.

Vesting and Release

The circulating supply at the time of launch would be at most 250 million PLY (25% of total supply). This includes 50 million PLY (5% of total supply) allocated for airdrops, marketing, and protocol partnerships, as well as, 200 million PLY (20% of supply) through the initial exchange as described in migration.The remaining 200 million PLY (20% of supply) allocated for migration will be released linearly over the project’s first two years as described in the mechanics of migration.150 million PLY (40% of supply) allocated for the core team shall be linearly vested for 2 years.The final 400 million PLY (40% of supply) will be provided as liquidity and locking incentives to the community through gauges and inflation of PLY lockers. The emission strategy is explained elaborately in the emissions section.The genesis supply would ideally be much less than the maximum figure of 250 million PLY since not all holders would migrate on the first day itself. Additionally, the 5% reserved for airdrops and partnerships shall be minted in parts, whenever required.

Circulating and Locked Supply

Due to the ve-model, a certain percentage of PLY will be locked as vePLY and directly affect the emission rate of PLY over time.

Vested PLY vested is minted on-demand whenever a claim is made. This ensures that at no point there is an ‘unused PLY’ supply that is locked away in any other form other than vote-escrow.

Over time, the total circulating supply i.e emission through gauges + locker inflation + vesting of migrated and team-allocated PLY would look like this:

Circulating supply for different values of locked supply

The knee at the 2-year mark is caused due to the ending of the vesting period for the team allocated and migrated PLY. Post that, the only way PLY comes into supply existence is through gauge emissions and locker inflation.

Migration

With the launch of the new Plenty.network protocol that comprises improved Plenty DEX, and EVM-bridge (taken over from wrap protocol), existing PLENTY and WRAP holders will be able to swap their tokens for PLY.

A total of 400 million PLY or 40% of the total supply is allocated for this initial migration — 32% for PLENTY holders and 8% for WRAP holders.

Mechanics of Migration

NOTE: The dates and exchange rates mentioned below are dummy values provisioned for readers’ understanding. These shall be replaced with actual values upon mainnet launch.

The migration is a 2-step process involving an initial exchange, followed by the vesting of tokens received. The exchange starts for example, on 24th November 2022, with the swap rates being as follows:

1 PLENTY = 8.5 PLY and 1 WRAP = 5 PLY

50% of the PLY you receive from the exchange will be available immediately and the remaining 50% shall be vested linearly up to 23rd November 2024. The vested tokens get unlocked by the second, but claims can be made only once every 24 hours.

There is no end date for migrating to PLY. You may swap your tokens “at will” once the exchange begins. Refer to the scenarios listed in the whitepaper to understand how the migration would work for different time frames.

Of the 400 million tokens allocated for migration, 200 million tokens would be available on the day the exchange starts. The remaining 200 million tokens would keep coming into circulation up to, and beyond 23rd November 2024.

Emissions

A total of 400 million PLY (40% of supply) will be distributed as liquidity incentives through gauges and locking incentives through anti-dilution inflation of lockers.

The gauge emission in the first year would be set at 2 million PLY/week, distributed across the gauges of all liquidity pools based on their weekly vote shares. The emission rate would be dropped by a factor of ~√2 at yearly intervals.

In the first 4 weeks of launch, an extra 1 million PLY would be distributed every week through the gauges to reward early adopters.

As described in our modified ve(3,3) model, the emissions would further be adjusted based on the locked PLY supply and accompanied by the inflation of lockers to protect from dilution.

A Visual Peek

The cumulative emission through the gauges for different percentages of locked PLY supply:

Gauge emissions for different locked supplies

The cumulative inflation of PLY lockers for different percentages of locked PLY:

The combined cumulative increase in PLY supply through gauge emission and locker inflation:

About Plenty

The Plenty team is building an all-in-one decentralized platform on Tezos. Plenty will allow swaps on uncorrelated assets, and low-cost, near 0 slippage trades on tightly correlated assets. Plenty also features a built-in bridge from multiple EVM blockchains to Tezos.

Website: plenty.network

Whitepaper: whitepaper.plenty.network

Discord: discord.gg/plentynetwork

Twitter: twitter.com/plenty_network

PLY Tokenomics was originally published in Plenty on Medium, where people are continuing the conversation by highlighting and responding to this story.